Valuation is the process of finding the real worth of a property in the market, when it is kept in the open market for sale without having any kind biased interests acting on it. Previous sale instances, local inquiries and applying logical thought process make the Valuation a perfect document. There shall not be any ownership issues related to the land or building. There must be a well defined owner(s) who can make the sale or lease. The ambiguity in the ownership shall affect the Value of the property. So the revenue records related to the property play a major role in the Value of property. A qualified advocate can trace the ownership and comment on the property ownership.

A professionally crafted Valuation Report will help you to assess the following type of Values.

- Fair Value of property as per Government norms – Govt fix the price

- The Fair Market Value – the selling place

- Distress Sale Value – the quick sale price

- Forced Sale Value – Value under some external influences

We use traditional as well as latest technologies for the Valuation works. Rent Capitalization Method, Land and Building Method, Composite Method are some of them.

Banks and financial Institutions make Loan to its customers based on the Value of the Collateral Security. This collateral Security should fetch a decent price, otherwise your property will help you to get a resonable loan from a Bank.

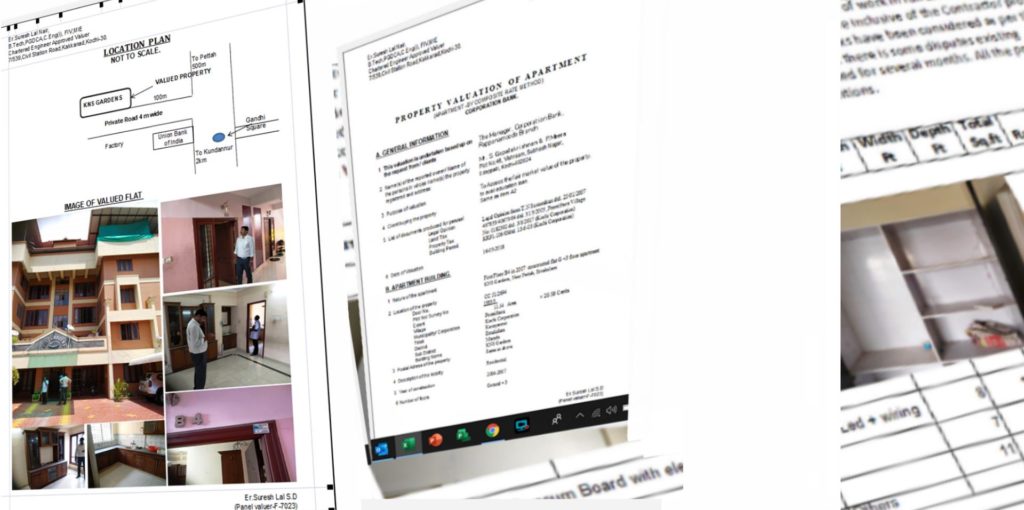

Our MD, Er. Suresh Lal SD is a Chartered Engineer and Approved Valuer. He is the Life Member and Fellow of the Institution of Valuers. He is doing Valuations for many Banks and private parties for the past 20 years. His Valuations are not been questioned or challenged so far by any agency. He is doing truthful, genuine and reasonable Valuation, which benefits both the bank as well as the borrower.

Do you wish to study Valuation and want to become an Approved Valuer ?

Want to make a Valuation Report ?